The Best Feng Shui Bedroom Layouts for Good Energy

The practice of Feng Shui has gained popularity when it comes to creating a harmonious and positive energy flow in our living spaces. In this guide, we will explore the best Feng Shui bedroom layouts that can help improve the energy in your bedroom.

By incorporating these Feng Shui bedroom rules and knowing where to put your bed, you can create a peaceful and balanced atmosphere.

So, let’s dive into it!

Understanding Feng Shui for the Bedroom Layouts

To create a harmonious and balanced bedroom environment, one needs to understand the fundamentals of Feng Shui for the bedroom layouts. Consider the following key points:

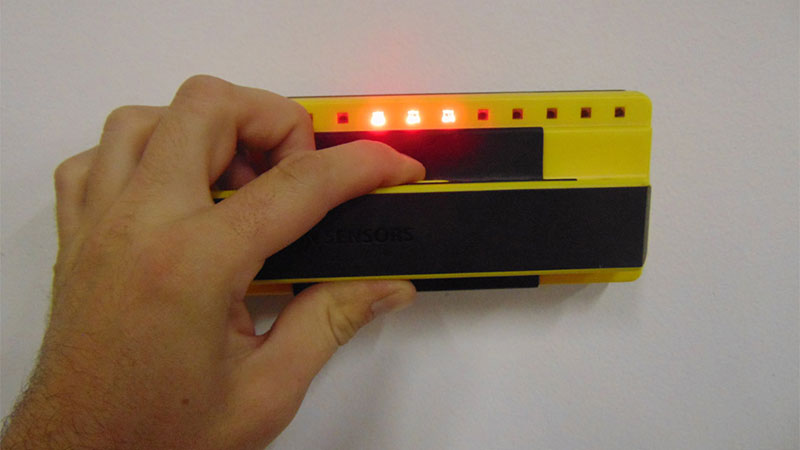

- Clearing clutter: Clearing clutter from your bedroom is the first step. A clutter-free environment allows positive energy to flow freely.

- Bed placement: Your bed is the most important furniture piece in the bedroom. It should be placed opposite the bedroom door in a commanding position, providing a sense of safety and control.

Feng Shui Bedroom Rules

Let’s explore some essential Feng Shui bedroom rules that will help you promote positive energy flow:

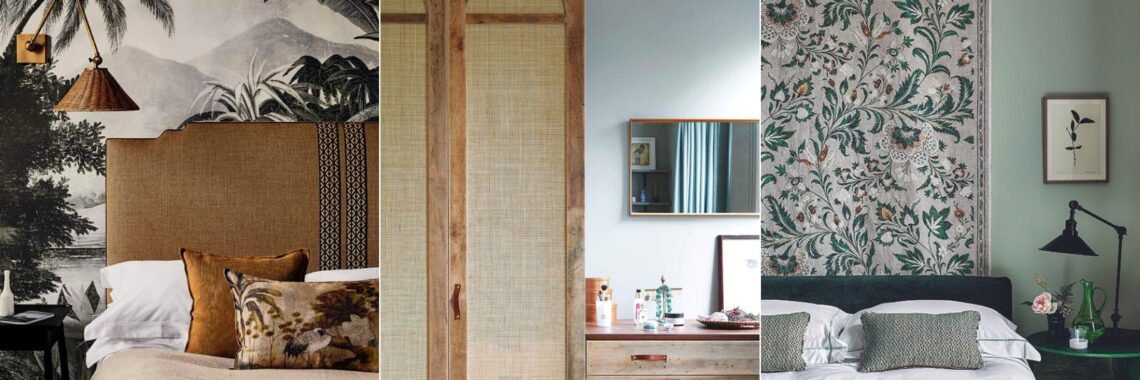

- Colors: Choose soothing and calming colors for your bedroom walls. Pastel shades, neutrals, and soft tones are ideal to create a tranquil atmosphere.

- Lighting: